Gold Price Forecast: It’s the Fundamentals, Stupid!

What the crowd gets wrong is that the price of gold is out of touch with the bearish fundamentals.

After the Consumer Price Index (CPI) underperformed expectations on Nov. 10, the crowd decided that the Fed’s inflation fight was over and a dovish pivot was on the horizon. However, I warned on Nov. 11 that the narrative was much more semblance than substance. I wrote:

While investors celebrated the mild drop in the CPI, their willingness to assume that inflation will decline linearly should be their downfall. Throughout 2022, bear market rallies have uplifted gold, silver, mining stocks and the S&P 500 as uninformed narratives are powerful. However, their short shelf life has culminated with new lows once reality re-emerged. Thus, we expect a similar outcome over the medium term.

To that point, while some financial assets have adjusted, the PMs and the S&P 500 remain in denial, and the bulls don’t realize that a dovish 180 is a figment of their imagination.

Please see below:

Source: Bloomberg/ZeroHedge

Source: Bloomberg/ZeroHedge

To explain, the red line above tracks the peak U.S. federal funds rate (FFR) implied by the futures market, while the green line above tracks the inverted (down means up) number of rate cuts priced in thereafter.

If you analyze the left side of the chart, you can see that rate hike expectations decreased and rate cut expectations increased following the CPI release on Nov. 10. However, if you turn your attention to the right side of the chart, you can see that reality has resurfaced, and the red line has erased nearly all of its post-CPI losses.

Therefore, dovish bets have been unwound, hawkish bets have returned, and the narrative that uplifted the gold price and the S&P 500 has evaporated. As a result, while investors continue to buy hope and sell reality, the fundamental implications of a higher FFR should prove problematic for the PMs in the months ahead.

In addition, while Fed Chairman Jerome Powell was crystal clear during his post-FOMC press conference on Nov. 2, Fed officials have ramped up their hawkish rhetoric in recent days. Whether it was Waller, Bullard, Kashkari, Jefferson, Daly or Williams, officials reasserted their commitment to combatting inflation.

Moreover, Boston Fed President Susan Collins said on Nov. 18:

“We're starting to see some promising signs, although certainly we're not seeing clear consistent evidence of the kind of softening in labor markets, the kind of dynamic that we would like to see and service sector prices are still very high. I do not see clear, significant evidence that the overall inflation rate is coming down at this point.”

She added:

“Restoring price stability remains the current imperative and it is clear that there is more work to do…. I would say that some of the data that we've seen since [the last FOMC meeting] has increased at the top of where [the FFR] might need to go.”

As such, while investors prioritize bullish seasonality and ignore the bearish fundamentals, the latter should reign supreme when sentiment shifts, as has been the case throughout 2022.

Please see below:

Source: Reuters

Source: Reuters

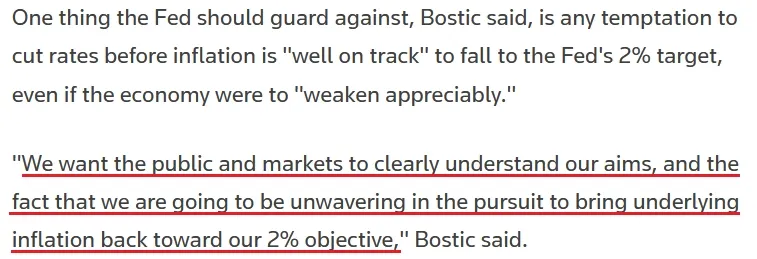

Likewise, Atlanta Fed President Raphael Bostic said on Nov. 19:

“If the economy proceeds as I expect, I believe that 75 to 100 basis points of additional tightening will be warranted. I believe this level of the policy rate will be sufficient to rein in inflation over a reasonable time horizon.”

He added:

“If it turns out that that policy is not sufficiently restrictive to rein in inflation, then additional policy tightening actions may be appropriate.

“On the other hand, if economic conditions weaken appreciably – for example, if unemployment rises uncomfortably – it will be important to resist the temptation to react by reversing our policy course until it is clear that inflation is well on track to return to our longer-run target of 2%.”

So, with Bostic basically warning that a recession is not grounds for a pivot as long as inflation remains high, the investors bidding up the gold price materially underestimate the fundamental challenges that lie ahead.

Please see below:

Source: Reuters

Source: Reuters

Overall, seasonality has clouded investors’ judgment, as they assume that historically bullish periods should repeat, even when the fundamentals are drastically different. Furthermore, Fed officials’ rhetoric is crucial, and I’ve been warning about the ramifications for many months. To explain, I wrote on Dec. 16, 2021:

As one of the most important quotes of the [post-FOMC] press conference, [Powell] admitted:

“My colleagues were out talking about a faster taper and that doesn’t happen by accident. They were out talking about a faster taper before the president made his decision. So it’s a decision that effectively was more than entrained.”

And while Powell sounded a little rattled during the exchange, his slip highlights the importance of Fed officials’ hawkish rhetoric. Essentially, when Clarida, Waller, Bostic, Bullard, etc., are making the hawkish rounds, “that doesn’t happen by accident.” As such, it’s an admission that his understudies serve as messengers for pre-determined policy decisions.

Therefore, the critical point is that Powell's deputies promote the FOMC's policy preferences, and despite being an obvious initiator for several months, investors still haven't figured this out. Consequently, when the next hawkish development surprises the crowd, please remember that Powell's conduits already sounded the alarm.

Good News Is Bad News for the Gold Price

While the bulls pray for demand destruction and an eventual Fed pivot, timing matters, and the proponents have been screaming recession since the summer. For context, a recession is not bullish for the GDXJ ETF, the S&P 500, or the gold price. However, the crowd is so desperate for a dovish 180, they don’t understand that real pivots are highly bearish, and often occur when the economic outlook is dire.

In contrast, the U.S. economy remains on solid footing right now, and the medium-term outlooks are bullish for the FFR, real yields and the USD Index.

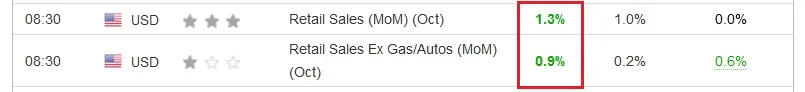

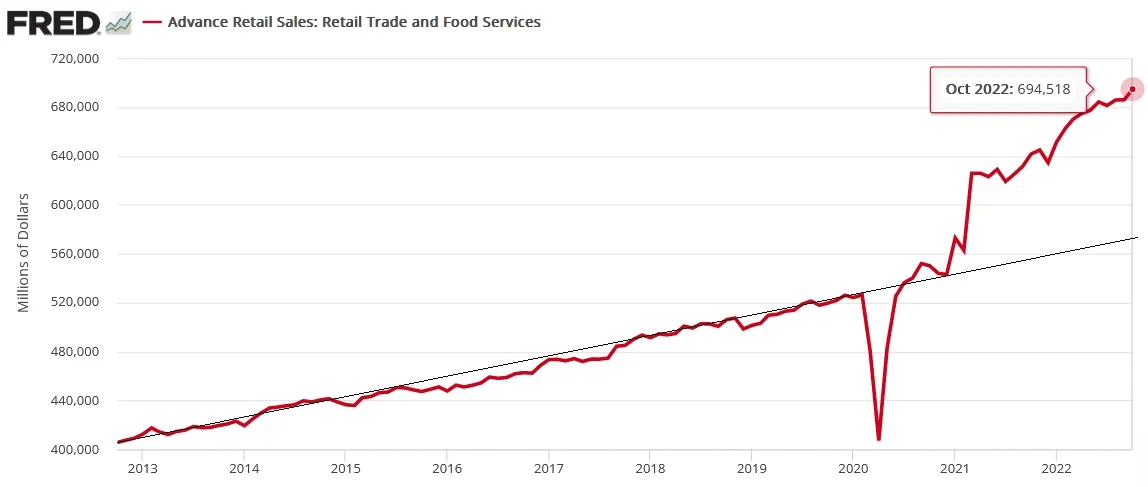

For example, I noted on Nov. 17 how U.S. retail sales rallied sharply in October. I wrote:

The U.S. Census Bureau released its retail sales report on Nov. 16; and with the metric hitting a new all-time high and outperforming expectations, investors still underestimate Americans’ ability and willingness to spend.

Please see below:

Also, the resiliency of demand highlights why wage and output inflation should remain uplifted and force the FFR higher.

Please see below:

To explain, the red line above tracks the dollar value of U.S. retail sales. If you analyze the right side of the chart, you can see that the Fed’s 15 25 basis point rate hikes in 2022 have done little to slow down American consumers.

In addition, with Mastercard’s SpendingPulse U.S. retail sales report also robust, the Atlanta Fed’s Q4 real GDP growth forecast north of 4%, and the Atlanta Fed’s Wage Growth Tracker re-accelerating in October, the backdrop on Main Street is relatively resilient.

However, what’s bullish for Main Street is bearish for Wall Street because it supports a higher FFR; and with consumer strength still prevalent, the crowd underestimates the Fed’s conundrum.

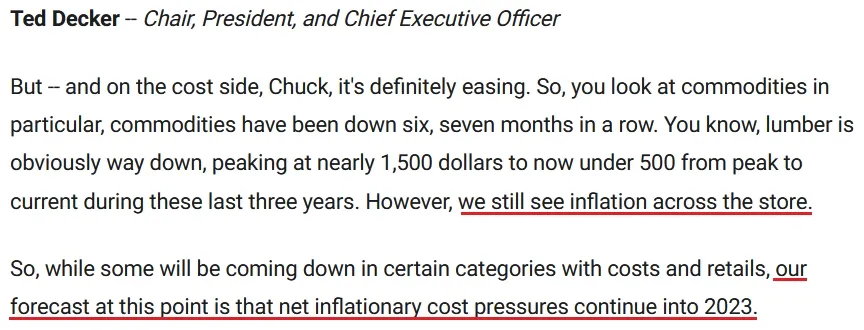

The Home Depot released its third-quarter earnings on Nov. 15. CEO Ted Decker said during the Q3 conference call:

“Our results in the quarter reflect continued solid demand for home improvement projects. While we did see some deceleration in certain products and categories, as Jeff will detail, the project business remains strong across most of our departments. We also saw year-over-year (YoY) growth with both our pro and DIY customers in the quarter.”

As a result, while Home Depot’s “consumer remains resilient” amid this “unique environment,” the largest home improvement retailer in the U.S. expects inflation to persist in 2023.

Please see below:

Source: The Home Depot/The Motley Fool

Source: The Home Depot/The Motley Fool

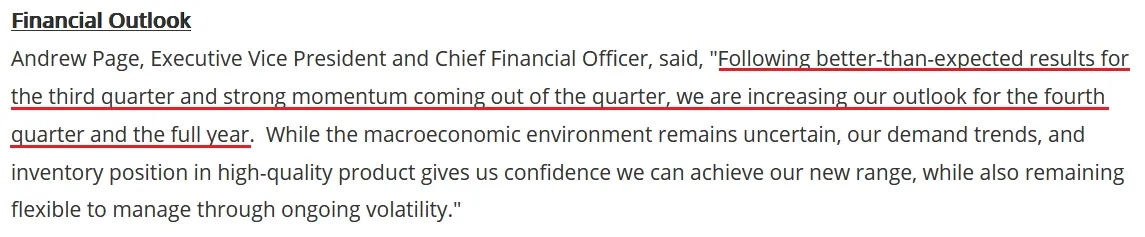

Similarly, Footlocker – a U.S. (and global) sportswear and footwear retailer – released its third-quarter earnings on Nov. 18. CEO Mary Dillon said during the Q3 conference call:

“Inflation is high. Fortunately, unemployment is low and wages are rising; we're seeing this category and our shoppers to be pretty resilient and very resilient and picking us.”

CFO Andrew Page added:

“We are excited about the momentum in the business, the resiliency we have seen in our customers and our growing ability to better serve them.”

So, while the crowd searches for demand destruction, the reality is that Americans continue to shop, and our 2023 FFR estimate of 4.5% to 5.5% may prove too low when it’s all said and done.

Source: Foot Locker

Source: Foot Locker

The Bottom Line

While rate hike expectations have ratcheted higher once again, risk assets have not re-priced to reflect this reality. Moreover, with investors still assuming that inflation will magically disappear and the Fed will cut rates, the proponents of this theory should suffer profound disappointment over the medium term.

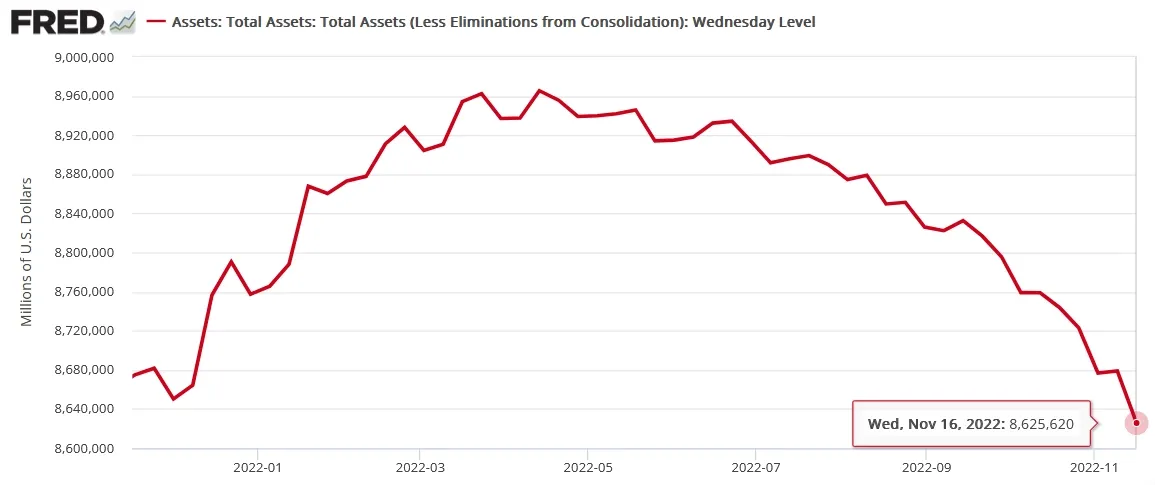

In conclusion, the PMs were mixed on Nov. 18, as the gold price declined. However, the USD Index and the U.S. 10-Year real yield increased, and both should seek higher ground in the months ahead; and let’s not forget: the Fed’s balance sheet continues to contract, and the liquidity drain adds another bearish layer to the rate hike crusade.

Alex Demolitor

Precious Metals Strategist