Inflation Cooldown Makes Gold Hot

The CPI inflation rate declined further, which helped gold to continue its rally. Is there a light at the end of the tunnel?

It seems so – and it’s not the train’s light, but disinflationary light!

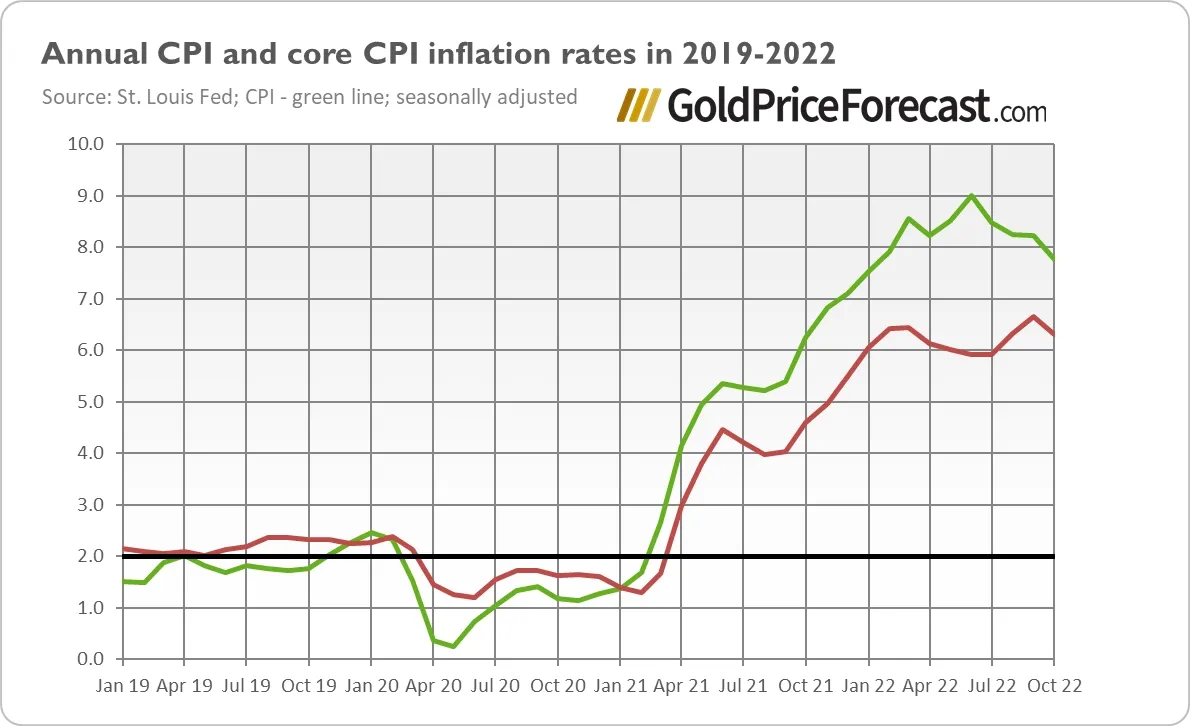

The CPI increased 0.4% in October, the same as in September, according to the Bureau of Labor Statistics . However, the core CPI, which excludes food and energy prices, rose 0.3% last month, compared to 0.6% in September. What’s even more important, the overall CPI increased 7.8% for the 12 months ending October , which means a significant deceleration from 8.2% seen in September, as the chart below shows. It’s also slightly below the expectations. The core CPI increased 6.3% in October, compared to 6.6% in the previous month. This decline could mean that the peak in core inflation is already behind us. Of course, inflation remains disturbingly high, but I think it’s safe to state at this point that disinflation has begun .

Disinflation Implies More Dovish Fed

The lower inflation numbers than expected were welcomed by the Wall Street, as stocks surged. Meanwhile, the greenback and the bond yields declined. Why? Well, cooler-than-expected inflation suggests that the Fed’s tightening cycle is beginning to have its intended effect. If so, the Fed could be less hawkish in the future . Indeed, the expected path of the federal funds rate has flattened. According to the CME FedWatch Tool , financial markets assign now only a 15% chance of a 75-basis point hike at December meeting, compared to 48% odds seen one week ago. It means that they expect a smaller, 50-basis point interest rate hike next month.

Implications for Gold

What does it all mean for the gold market? Well, inflation’s cooling down has been positive for the gold prices . The softened expectations of the Fed’s interest rate hikes and declined in the bond yields pushed the gold prices up from $1,715 to almost $1,760, as the chart below shows.

What’s here important that on November 10 th , gold continued a rally that actually started in the previous week. It gives us hope that the upward move would be more lasting. It’s too early to declare the full comeback of the bull market , but gold’s return above $1,700 is encouraging . And its timing would be completely justified – after all, the Fed’s interest rate hike in November could be the last such large increase. The federal funds rate is going to rise further, but the Fed is likely to slow down with the hikes. Hence, it wouldn’t be surprising if the bottom in gold occurred just around the peak in the Fed’s hawkishness .

Thank you.

Arkadiusz Sieroń, PhD